Doodoo economics

economists, I’ll refer to “doctors” as medical doctors – or quacks as I have heard them affectionately called here in Sydney.)

economists, I’ll refer to “doctors” as medical doctors – or quacks as I have heard them affectionately called here in Sydney.)A doctor sees a patient, diagnoses the ailment and then sets out to intervene if at all possible to alleviate the ailment or its effects. A doctor could just se

e the patient and enter a diagnosis and prognosis: this patient will live and the ailment will eventually resolve itself, this patient will live but will live a suboptimal life because the ailment will dog him until he dies, this patient will die a miserable death, this patient will die tomorrow, etc.

e the patient and enter a diagnosis and prognosis: this patient will live and the ailment will eventually resolve itself, this patient will live but will live a suboptimal life because the ailment will dog him until he dies, this patient will die a miserable death, this patient will die tomorrow, etc.The essence of doctoring is intervention in the natural course of events. For instance, the whole notion of triage is an artfully sculpted science (or a scientifically ordered art, I’m not sure which) to apply doctoring to extreme events where resources do not provide enough doctoring to attend to everyone’s ailment.

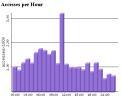

I raise this in the context of the current discussions as to whether there is

“price gouging” going on in the aftermath of Katrina. Price “gouging” is a common notion, but what we mean by it is less common. We also speak at times of a price “spike”. Price “bubbles” are also common topics of discussion.

“price gouging” going on in the aftermath of Katrina. Price “gouging” is a common notion, but what we mean by it is less common. We also speak at times of a price “spike”. Price “bubbles” are also common topics of discussion. In each case we are talking about “unusual” price increases. (“Unusual” price declines are often spoken of as “windfalls” and

“bloody good luck”, etc., assuming we’re the buyer, otherwise it’s the fault of cheap Chinese labour or Indian outsourcing.) But each term carries with it connotations of human context and moral judgment. A bubble

“bloody good luck”, etc., assuming we’re the buyer, otherwise it’s the fault of cheap Chinese labour or Indian outsourcing.) But each term carries with it connotations of human context and moral judgment. A bubble suggests mindless mania without “rational” regard to “value”. A spike is almost benign, suggesting an understandable bump caused by unusual and self-correcting forces beyond our control.

suggests mindless mania without “rational” regard to “value”. A spike is almost benign, suggesting an understandable bump caused by unusual and self-correcting forces beyond our control.  But gouging is particularly a mean thing. It’s what you do to eyes; it suggests cruel digging and prying away. Like the word "chissel", which is also a tool used to gouge wood. There is a definite hint of “undeserved” in the term. At least, I’m pretty sure that would be the understanding in common parlance. And in that regard, price gougers are usually regarded with opprobrium.

But gouging is particularly a mean thing. It’s what you do to eyes; it suggests cruel digging and prying away. Like the word "chissel", which is also a tool used to gouge wood. There is a definite hint of “undeserved” in the term. At least, I’m pretty sure that would be the understanding in common parlance. And in that regard, price gougers are usually regarded with opprobrium.But not by economists. Economists are amoral in their world view. They only define good and bad by whether behaviour interferes with or contradicts their econometric models. Moral behaviour doesn’t have an algorithm. Thus, an economist would speak of a price gouger thusly: 'gougers' (defined as people who sell something at a price above what they paid for it) – (see, http://cafehayek.typepad.com/hayek/2005/09/random_thoughts.html)

Well, that is a pretty felicitous definition, and would explain away all our “ill conceived” notions of price gouging. I mean, hell, when I go to the store, I assume I'm paying more than the merchant did for my stuff, but I don't normally feel I'm being gouged.

But economists, you see, operate in the fantasy construct where goods sell for what it cost the seller for them; they call this equilibrium. “If the price rises, people will modify their habits and the market can be in equilibrium, even if it's an equilibrium we don't happen to like.... Let's be serious. [US]$5.87 [per gallon for petrol] seems to be above the market equilibrium, even in these times. But I wouldn't prosecute them. Not at all. I'd just tell people not to go there! Find another station! If you're running on empty, just buy a gallon and drive on." (http://www.williampolley.com/blog/archives/2005/09/gouging.html#trackbacks) .”

So prices might be out of whack, out of equilibrium, but that doesn’t make for price gouging, no siree.

So prices might be out of whack, out of equilibrium, but that doesn’t make for price gouging, no siree.Indeed, there is a school of thought that price gouging doesn’t even exist – it’s just a figment of our hyper-active, tv-thought-controlled minds. This guy, Iain Murray at http://www.techcentralstation.com/090705G.html, teaches “economics tells us that "gouging" simply doesn't exist in a rational market. Responsible higher prices actually ensure that as much of the good or service as possible is available for use. In an emergency, that is an important consideration.” See, that’s the problem. Gouging is a moral concept and there is no algorithm for it in a “rational market”.

You think I’m kidding, right? Surely economics must acknowledge some form of morality? Surely, they must take into consideration somewhere that some people might in any particular circumstance be unfairly worse off and deserve, as we say Down Here, a fair go?

Nope. Iain Murray debunks that straight away: “Rather than "gouging" members of the public, gas station owners are actually helping them by raising prices.” (Id.)

Fair go is no go for him: “Ah, but what

of the hotel owner who has a captive market? Surely they are gouging people when they increase their rates when evacuees show up? Again, the higher price actually helps people. The evacuee is generally willing to pay more for overnight accommodation than the casual traveler because the evacuee has fewer options. Therefore, a higher price actually deters those who don't really need the rooms in favor of those who do. The result is more rooms available for those who really need them.” And can really afford them.

of the hotel owner who has a captive market? Surely they are gouging people when they increase their rates when evacuees show up? Again, the higher price actually helps people. The evacuee is generally willing to pay more for overnight accommodation than the casual traveler because the evacuee has fewer options. Therefore, a higher price actually deters those who don't really need the rooms in favor of those who do. The result is more rooms available for those who really need them.” And can really afford them.

The lesson here: charge the needy more than others. They'll thank you for it. No, really, they should.

If doctors were economists, they’d never get to diagnosis, to intervention, to cure. But they’d make dandy prognosticators. Or would they? Would their ethics get in the way?

Labels: Economy, Uber free markets

0 Comments:

Post a Comment

<< Home