Ar-r-r-r-b, Matey

Aye, the Pirates, they be at it again. This story comes via Minyanville by Jeff Saut of Raymond James with an assist and inspiration from Dr. Robert McHugh. And with the begats done, on with the show:

[W]e still can’t shake the “eerie” feeling that something’s unnatural about the stock market’s action. Yeah, I know that when anyone gets “wrong footed” in the markets there is the tendency to make excuses and my firm has clearly been too cautious.... It’s also worth noting that we’re not conspiracy theorists....

Yet, there remains an eerie “bid” in the equity markets since those July lows.

For example, markets typically rally, then correct by about one-quarter to one-third of that rally’s point gain, before beginning another rally phase. After that phase, they again correct by one-quarter to one-third before re-rallying. This, however, has not been the case recently.

Indeed, every time it looked like the indices were about to correct, mysterious buyers materialized in the futures markets. Those “buyers” tend to widen the futures premiums so far above the cash markets that it attracts arbitrageurs. The arbs, in turn, short the futures and buy the appropriate baskets of stocks.

That operation allows the arbs to “lock in” the spread between the futures price and what they paid for the basket of stocks, assuring them a risk-less profit and, in the process, driving stocks higher.

Evidentially, we are not the only ones that have noticed this “eerie situation” for savvy seer Dr. Robert McHugh (www.technicalindicatorindex.com) recently wrote, as paraphrased by me:

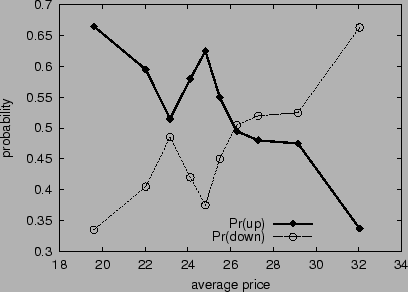

The rally since July has been almost entirely short-covering. We get one big move, about once a week, on buying panic, then no follow-up. . . . Get this: all of the progress of this three-month summer/autumn rally, all of it, occurred in only nine days of trading, and all but one of the nine was a short-covering rally. . . . Other than those nine trading days out of 63 since July 14th, the other 54 days of trading produced only 4% of the upside progress, and zero since July 19th. ZERO . . .!

While my firm can’t tell if those nine sessions were all “short covering,” we did take the time to check Dr. McHugh’s keen insights and found them to be right on point as can be seen in the chart below. Amazingly, those nine sessions [7-19 (+212); 7-24 (+182); 7-28 (+119); 8-15 (+132); 8-16 (+97); 9-12 (+101); 9-26 (+93); 10-4 (+123); 10-12 (96)] accounted for 1155 of the Dow’s 1200-point gain from the July lows.

Even more amazing is that on ALL of those nine trading days, according to our notes, showed that the aforementioned “mysterious” futures buyers were at work with the attendant arbs’ action.

When we combine this “mysterious” equity action with the “mysterious” re-balancing of Goldman Sach’s (GS) much institutionally indexed commodity index (GSCI), from a 7.3% gasoline weighting to 2.5% into the November elections, we find ourselves “mysteriously cautious.”

While we don’t trust it, nor understand it, in this business what you see is what you get!

Again this morning those “mysterious buyers” have shown up, lifting the S&P 500 pre-opening futures from down about three points early this morning to nearly even as of this writing. [The Dow busted up just over 100 points early in the session, and then just went sideways the rest of the session, just like the other 9 times.]

So, what seems to be happening is that some seriously big money is setting up some funds for an arbitration play.

The classic arbitration play is considered nearly riskless and, consequently, it doesn't generate a big profit margin, so you have to do it often and in mighty big licks to make any money out of it. For a tutorial and overview of the arbitrage game, see this explanation from riskglossary.com, and be sure to follow the links to the subtopics.

Arbitrage started out when traders began to perceive mispricing opportunities. But that is so yesterday. Now, the big funds create their own mispricing opportunities.

The thing to note about this surmised strategy is that it is directionally agnostic, in a sense. That is, to the extent that the arbitrage profit is locked in at a significant enough margin to matter, the arbitrageurs don't care which direction the market came from or is going. But the set-up for these (supposed) arbitrage plays does require a rapidly moving market to manufacture the arb-atunity. For "the boys" to push the market, they will try the path of least resistance. Since the move began off noteworthy lows, that path was up.

Their cause was aided by the large portion of the trading crowd that felt the markets were becoming overbought and "due" for a correction. Their short positioning was the fuel that kept the set-up going.

But at some point, the market will get high enough that profit takers and other sellers will step in, and the buyers that get sucked along by the buying strategy will thin out. Then the path of least resistance will be down.

And this is the interesting part. The set-up and arbitrage strategy will make money for the arbs even in a falling market, if it falls fast enough to set up the mispricing.

Therefore, if this really is big money setting up arbitrage opportunities, they can push the market back down just as far and just as fast, and with the same incentive and arbitrage opportunites, as happened on the upside.

There's just nothing that big money can't or won't try to do.

1 Comments:

fascinating...

if only Jess would care to listen to my account of this tale.

Post a Comment

<< Home