A question of priorities

The bizzoids here in Australia have gone ballistic. If you accept their take on it, the whole world of the relationship between company creditors and equity stakeholders has been thrown topsy-turvy in the arbitrary stroke of a judge's pen. For instance, Elizabeth Knight headlines her column in the print edition of today's SMH: "Judge alters balance between debt and equity" (http://www.smh.com.au/news/business/judge-shifts-debt-equity-balance/2005/09/15/1126750077006.html)

But before I go on, I need to put you in the picture as to what this is all about. There are facts and there are principles.

Take the "facts" first. The case arose out of the meltdown of gold miner Sons of Gwalia. I have previously refered to this case: http://guambatstew.blogspot.com/2005/08/got-shaft.html The mining company was apparently a great gold producer, but a lousy gold producer manager. Though there are denials of any negligent or intentional wrongdoing, for purposes of this issue spotting exercise, let's assume that

the management tried to smooth income over time by entering into gold hedging contracts and that these contracts went horribly wrong to the tune of losses amounting into the millions and millions of dollars. Let's also assume that this was more than a minor embarrassment and inconvenience and that management decided that the losses were best kept "off balance sheet" so as not to detract from their excellent gold production record. Oh, and that they never told the shareholders or the market more broadly about that dirtly little secret. (See, http://www.smh.com.au/news/business/how-sons-of-lalor-built-then-sank-sons-of-gwalia/2005/08/21/1124562748347.html.)

the management tried to smooth income over time by entering into gold hedging contracts and that these contracts went horribly wrong to the tune of losses amounting into the millions and millions of dollars. Let's also assume that this was more than a minor embarrassment and inconvenience and that management decided that the losses were best kept "off balance sheet" so as not to detract from their excellent gold production record. Oh, and that they never told the shareholders or the market more broadly about that dirtly little secret. (See, http://www.smh.com.au/news/business/how-sons-of-lalor-built-then-sank-sons-of-gwalia/2005/08/21/1124562748347.html.) OK, we're assuming a lot of "facts" here, but at this stage of the legal proceedings (a matter the commentators also overlook), we have to assume a few things. There's plenty of time down the track to sort out allegation from damage.

Now there are the principles. But first let's make the distinction between shareholders and creditors. When people buy company stock, they are buying ownership in the company. The company does not promise to pay it back. Their money is entirely at risk without legal expectation of payback. When people loan money to a company, the company does promise to pay it back. That money is also entirely at risk but comes with a legal expections of being paid back.

Now lets deal with principles relating to what happens when a company goes belly up. At that time there is an assessment made of how much value there is left in the company. The usual case is that there is not enough to pay back all the creditors in full and pay back all the money the stockholders paid for their shares.

Since the company never promised to repay shareholder money, but did promise to repay creditor money, the law provides that creditors get repaid in

full before the shareholders get anything. There are many principles and rules as to other priorities amongst different types and classes of creditors, but we don't need to go into that in this discussion. Suffice it to say that the creditors as a group have priority over shareholder claims to company assests. This is the traditional, broadly accepted concept of the "balance between debt and equity".

full before the shareholders get anything. There are many principles and rules as to other priorities amongst different types and classes of creditors, but we don't need to go into that in this discussion. Suffice it to say that the creditors as a group have priority over shareholder claims to company assests. This is the traditional, broadly accepted concept of the "balance between debt and equity".But what are creditors? Creditors are people having a claim for money owed them. Obviously, someone who lends money is owed it back and is a creditor. And someone who has supplied goods or services to the company is owed for the value or agreed price of that and is a creditor. But there are other types as well. The government is owed for taxes it levies and is a creditor. And if the company injured anyone, the injured person is owed compensation and is therefor a creditor, also.

So, suppose one of the company's ore trucks negligently ran over someone. And suppose that person also just happened to be a shareholder. That person then became a creditor and a shareholder; a creditor to the value of his damages and a shareholder to the value of his shares. On winding up of the company, the creditor claim for injuries would be paid along with other creditor claims before any return in respect of the shareholding. Being a shareholder does not invalidate nor change the priority of his creditor claim.

Look, I'm sorry. I know this is all too elementary. You'd expect this even if you didn't already know it. Bear with me.

Now let's assume that the injured shareholder didn't sustain his injury by being run over by a company truck. Let's consider the case where the company was hiding mammoth losses in off-the-books transactions and the shareholding was purchased without knowledge of the losses; think Enron or think the assumed set of facts outlined above. Here you have a shareholder who is damaged by virtue of owning the shares. His damages are indistinguishable in effect from any other shareholder, but arose because of fraud committed on this shareholder.

The thing that has all the commentators commentating about the SoG case is that the judge has ruled that some of the shareholders, those who were defrauded, are creditors also. These commentators have grown up in a world where all shareholders, in their capacity as shareholders, were treated the same, even if some shareholders owned their share on the basis of information unknown to others, and even if, as is the case here, some shareholders bought their shares on the basis of misleading information supplied by the company.

The thing that has all the commentators commentating about the SoG case is that the judge has ruled that some of the shareholders, those who were defrauded, are creditors also. These commentators have grown up in a world where all shareholders, in their capacity as shareholders, were treated the same, even if some shareholders owned their share on the basis of information unknown to others, and even if, as is the case here, some shareholders bought their shares on the basis of misleading information supplied by the company. For instance, SMH's Stephen Bartholomeusz writes in his column ("Bankruptcy pecking order overturned"), "In essence, the two judges have concluded that a claim by a shareholder on the basis of misrepresentation by the company isn't a debt owed by the company to the shareholder in their capacity as a member of the company but, if it is a debt, it arises from various consumer protection provisions that prohibit misleading and deceptive conduct. That opens a can of worms because it undermines the long-standing conviction that shareholders, in return for gaining limited liability, rank behind other creditors in the event their company goes into administration or liquidation." (http://www.smh.com.au/news/business/bankruptcy-pecking-order-overturned/2005/09/15/1126750077018.html.)

I'd have to guess that these commentators just never saw it coming. They just never considered that fraud was the basis of a creditor claim. Otherwise, you'd have to conclude that they consider fraud to be one of the risks that a shareholder assumed when buying shares.

It really shouldn't be a surprise nor any watershed moment. Consider the case where one company buys into another company; that is, becomes the shareholder of another company. Suppose they negotiate the purchase and then later discover they were sold a bag of goods (sound familiar? GIO? HIH?). Are they barred from recovery because the fraud involved the sale of shares? Of course not. If there is a difference, the only difference between such a case and the claims being made against Sons of Gwalia is that, in this example there was a "direct" fraud on that shareholder and in the Sons of Gwalia case the fraud is "on the market".

Courts have struggled with and developed the notion of fraud in shareholder suits. In traditional fraud analysis it was usually the rule that there was no fraud without intent and the intent was limited to only applying to either the intended victim or the proximately, reasonably foreseeable victim, and the common garden variety shareholder was not seen as part of that crowd. But the courts developed the theory to include them in cases of fraud on the market, otherwise particularly eggregious cases of shareholder loss went unremediable. (See, e.g., http://www.canoe.ca/MoneyBreXSaga/oct20_lawyerinbr.html and http://corplawcenter.bna.com/pic2/clb.nsf/id/BNAP-5YAUBK?OpenDocument.)

And that's all that is happening here. The court is applying the traditional concept of fraud in the new context of specific legislation which makes it

easier to make out the fraud in fact. The judges are not creating new law, they are merely applying it with the aid of new legislation.

easier to make out the fraud in fact. The judges are not creating new law, they are merely applying it with the aid of new legislation.And it bears pointing out that the cases involving the Sons of Gwalia shareholders is not anywhere near making a finding of fact of fraud nor damages. The case is only at the stage of trying to determine if the shareholders will have the opportunity to try to prove they were defrauded and the damages to flow from it. Tis still a long way twixt cup and lip.

The hue and cry is that lender creditors are now somehow disadvantaged because they may have to share some spoils with defrauded shareholders. In simplest form that argument is that the shareholder should be stripped of modern market, corporate and consumer protections and made subject to the ancient test of caveat emptor, and that the risk of breach of promise is more rewardable than the risk of breach of trust.

As Elizebeth Knight said the the article cited above, "Suffice to say, if the shareholders were not misled in the lead-up to a corporate collapse they might be considered just garden variety shareholders that rank at the bottom of the pack and normally never see a cent of their money again. The funny thing is that it's hard to remember a corporate collapse that didn't involve some kind of deceptive and misleading behaviour in the lead-up to the ultimate demise. The way these things usually play out is that the companies get into financial strife and begin a campaign of hiding the facts in an attempt to claw their way out of it. The truth is usually the first victim in a corporate collapse and shareholders run a close second. If that is all shareholders need to establish to elevate their status to that of a creditor, it's pretty predictable a class action to establish a trade practices claim of false and misleading conduct by the company will almost always follow the appointment of an administrator."

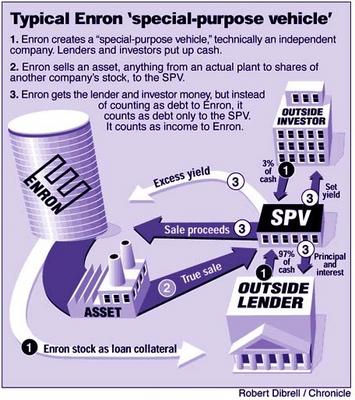

The worry and woe expressed is that this ruling will increase the cost of debt funding. On the other hand, it may just give all the banks and other lenders the incentive they need to make sure their borrowers are fair dinkum with their use of funds and discourage those same lenders from creating and marketing all those clever little hedging schemes, special purpose vehicles and other tricks that have facilitated the kinds of off-balance-sheet shenanigans in the first place: see http://guambatstew.blogspot.com/2005/08/we-did-nothing-wrong-mind-you-but.html

Meanwhile, if anyone tries to argue that defrauded shareholders should be subordinated to other creditors, they should get their priorities straightened.

Case citation: http://www.austlii.edu.au/au/cases/cth/federal_ct/2005/1305.html

Labels: Australia, Favorite posts, Legal

0 Comments:

Post a Comment

<< Home